Email ID: contact@freelancingwithumesh.com

RECONCILING ACCOUNTS IN QUICKBOOKS ONLINE

OUR MOST POPULAR BLOG POST – QUICKBOOKS ONLINE BANKING TUTORIAL

The #1 question I am asked all the time by new (and some not so new) QuickBooks Online users is: how to work with and reconcile banking transactions in QuickBooks Online. Working with banking transactions in QBO seems simple, but there are a few important things you need to know in order to avoid the most common mistakes that all new users make

ADD BANK AND CREDIT CARD ACCOUNTS TO THE CHART OF ACCOUNTS

If you’re a QBO newbie, you first need to add your bank and credit card accounts to the chart of accounts. See my post for instructions on how to add accounts to the chart of accounts.

Expert tip: Add your business bank and credit card accounts (not personal accounts).

CONNECT BANK AND CREDIT CARD ACCOUNTS TO QUICKBOOKS ONLINE

Now that you have added your business bank and credit card accounts to the chart of accounts, you are ready to connect your bank and credit card accounts to QBO.

[Expert tip: You should add bank and credit card accounts to the chart of accounts in QBO before connecting your QuickBooks Online to your financial institutions.]

From the Left Navigation Bar

Click Banking

Click Add Account on the upper right

Enter the name of your Financial Institution or click the Logo of your Financial Institution

Enter your Online ID or User Name.

Enter your Passcode or Password. Then, click Log in

The connection process may take a few minutes.

A window will appear asking you to map the bank accounts from your financial institution to the bank accounts in your chart of accounts list.

Select the bank or credit card account by clicking on the box next to it (on the left). Then, select the corresponding account you set up in the QuickBooks chart of accounts (on the right side).

Typically, only 90 days of transactions will be downloaded.

A window opens indicating that banking transactions were successfully downloaded.

Expert tip: If you are new to QBO, connect your bank and credit card accounts to QBO the first time you start using QBO. Transactions will download automatically. Even if it takes you a few months to get started with QBO, the banking transactions will be there.

THINGS TO KNOW BEFORE YOU GET STARTED WORKING WITH BANKING TRANSACTIONS IN QUICKBOOKS ONLINE

Keep a few things in mind when working with banking transactions in QuickBooks Online:

-

It’s a tool to save data entry time

-

It does not replace bookkeeping

-

It’s not an automated process

-

You still have to spend time on bookkeeping (but hopefully a lot less time)

Many new QuickBooks Online users are disappointed when they realize that banking transactions don’t automatically get recorded in QBO.

RECONCILING BANKING TRANSACTIONS IN QBO – HOW TO ORGANIZE YOURSELF

Most QBO users get overwhelmed when they work with their banking transactions. That’s because they need a system. That’s why I created a 5-minute system for working with banking transactions. The idea is to work on similar types of transactions in order.

Work on banking transactions in the following order:

Step 1 – Money Out (spend) transactions

Step 2 – Money In (received) transactions

Step 3 – Transfers between accounts and credit card payments

STEP 1 – WORKING WITH “MONEY OUT” BANKING TRANSACTIONS IN QUICKBOOKS ONLINE

“Money Out” banking transactions include expenses and amounts in the “Spent” column in the Banking Center.

You can work with Money Out banking transactions in QBO in the following ways:

-

Add

-

Split

-

Batch Actions

-

Match

I’ll explain each of these method of working with Money Out banking transactions in QBO.

ADD – HOW TO ADD MONEY OUT BANKING TRANSACTIONS IN THE QBO BANKING CENTER

When you “add” transactions from the Banking Center, they are entered directly to QuickBooks.

Let’s work through an example using the QuickBooks Online Sample Company. Click here to access the QuickBooks Online Sample Company.

To add transactions, go to the Left Navigation Bar and click Banking.

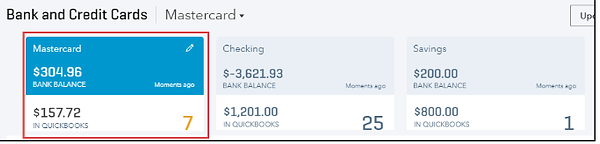

The Banking Center window will open.

Click the “For Review” tab to add transactions.

Click on the Mastercard account to select it.

Click a transaction to view its details. In this example, let’s click on Lara’s Lamination.

A window will open to show you more details of the transaction.

It is important to verify that each transaction has a Name (vendor/payee) and Account (Category from the chart of accounts list). Memos (descriptions) are always helpful.

Let’s add the vendor name and account category. We’ll add Lara’s Lamination as the vendor name and Office Expenses as the account category.

Click Add to add the transaction to QuickBooks Online

SPLIT – HOW TO ADD SPLIT BANKING TRANSACTIONS IN THE QBO BANKING CENTER

What if the expense you want to add needs more than one account category? Let’s go through an example with another transaction.

Still working with the Credit Card account – click the “Amazon” transaction to view its details. The transaction window will open to show you more details.

Click Split to open the split transaction window.

From the split transaction window (as shown in the image below), enter the following:

-

The vendor name (Amazon)

-

The account categories (We are splitting the transaction between two account categories – Office Expenses and Supplies)

-

The amounts for each account category (We are entering the corresponding amounts for each account category)

Click Save and add to add the transaction to QuickBooks.

BATCH ACTIONS – HOW TO ADD MULTIPLE MONEY OUT BANKING TRANSACTIONS IN THE QBO BANKING CENTER

A great way to save time is to use Batch actions in the Banking Center. Rather than clicking Add on every transaction, you can add them in Batch.

Make sure that you have added a payee and account category to each transaction.

Click on the boxes next to the transactions you want to add.

Click Batch Actions then click Accept Selected.

MATCH – HOW TO MATCH MONEY OUT BANKING TRANSACTIONS IN THE QBO BANKING CENTER

If you have already manually entered banking transactions in QBO (like Checks or vendor Bill Payments) and then download them from your bank, you will see that QBO will show that the downloaded transactions are marked at “Matched” in QBO.

Don’t worry, these transactions are generally not duplicated, QBO already knows that they are entered in QuickBooks. Simply click on “Match” on the right to accept these transactions.

Expert tip: Pay careful attention to ensure that you enter transactions in QuickBooks with the correct date and amount. Sometimes transactions do not match because of incorrect dates and amounts.

Expert tip: You can also use Batch action to add multiple matched transactions at the same time.

STEP 2 – WORKING WITH “MONEY IN” BANKING TRANSACTIONS IN QUICKBOOKS ONLINE

“Money In” transactions in QuickBooks Online are amounts received or deposited. Amounts received are listed under the “Received” column in the banking center.

As a general practice, Money In banking transactions in QBO should generally be Matched. Let’s go over this concept.

MATCH – HOW TO MATCH MONEY IN BANKING TRANSACTIONS IN THE QBO BANKING CENTER

As I mentioned, it is best to match most Money In transactions into QuickBooks – especially if you invoice customers. Depending on your workflow and specific business needs, you may match Money In transactions in two ways (Method #1 or Method #2).

MONEY IN METHOD #1

With this method, you will enter a customer invoice, receive payment, record a bank deposit and THEN Match the bank deposit to the corresponding transaction in the Banking Center.

Here is a video showing you how to enter an invoice, customer payment, and deposit:

After you enter the invoice, customer payment, and deposit, you will Match the deposit in the Banking Center, as shown below:

Click “Match” on the right to match the transactions (or use Batch actions).

MONEY IN METHOD #2

With this method, you will enter a customer invoice in QBO and THEN find a Match to the corresponding transaction in the Banking Center

LET’S GO OVER AN EXAMPLE:

Let’s assume that we entered two invoices in QuickBooks for $108 and $300.

Let’s also assume that we received one payment for $408 dated 9/10/16, as shown below.

Click on the transactions to view its details. Then click Find Match.

The Match transaction window opens. Find the transactions that make up the deposit received and click to select them.

Scroll to the bottom and make sure that the difference is zero.

Click Save. The transaction is added to QuickBooks.

Which method do you prefer? I like Method #1 because you can be more proactive about tracking Accounts Receivable and you can make sure that all customer payments are accounting for. Others like method #2 because it requires less data entry. Pick the method that best suits your specific business needs.

ADD – HOW TO ADD MISCELLANEOUS MONEY IN TRANSACTIONS

You may have transactions like credit card credits or refunds from vendors. We call these “Miscellaneous Deposits”. Let’s go through an example.

Let’s assume that you received a credit card credit from Amazon for $89.99.

First, you should know that credit card credits and refunds from vendors are recorded to the account category originally used to record the purchase.

In this case, the original purchase from Amazon was recorded to Supplies.

Click the transaction to view its details.

-

Enter the vendor name (Amazon)

-

Enter the account category originally used to record this purchase (Supplies)

-

Click “Add”

The transaction will be added to QuickBooks after you click Add.

OTHER MONEY IN TRANSACTIONS

It’s very tricky to write tutorials about QuickBooks Payments, Paypal, e-commerce and point-of-sale transactions. That’s because you generally need a customized workflow to record these transactions and also because it’s challenging to get sample data to show how to work with these types of Money In transactions.

I have included a tutorial for working with QuickBooks Payments in my paid course “Mastering QuickBooks Online Banking Transactions in 7 days.” For other types of Money In transactions, I recommend working with a QuickBooks Online expert who can help you customize these transactions to your specific workflows.

STEP 3 – WORKING WITH TRANSFERS IN THE BANKING CENTER

Did you know that you use Transfers in the QuickBooks Online Banking Center to record transfers between bank accounts and also to record credit card payments? I’ll show you the basics:

Let’s work through an example:

Let’s assume that you made a $10,000 transfer from your savings account to your operating (checking) account.

Next, let’s look at the checking (or operating) account.

Looking at the checking account, we can see that the money was received into the checking account.

So, what do you do now? You record the transfer.

Let’s stay in the checking account and click on the transaction to view more details.

Select Transfer.

"Bookkeeping service", ", "Quick book service","Quick Book Tutorial","Bookkeeping service","Low cost bookkeeping service","Bank reconcilation","How to do bank reconciliation in quickbook online"