Email ID: contact@freelancingwithumesh.com

How to Close the Books in QuickBooks Online

HOW TO CLOSE THE BOOKS IN QUICKBOOKS ONLINE – STEP BY STEP

We will show you how to close the books in QuickBooks Online so that you can prevent accidental mistakes from happening.

STEP 1

-

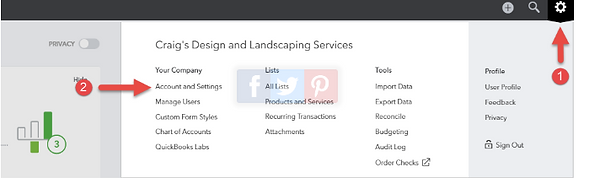

Select the Gear Icon in the upper right hand corner of the screen

-

Select Account and Settings

STEP 2

-

From the left-hand menu bar, select Advanced

-

Under Accounting, click the pencil icon

STEP 3

-

Check the box next to Close the books.

-

Enter the closing date. This can be the last date of the month or year. We recommend closing the books monthly.

-

You will then have two options

-

Allow changes after viewing a warning.

-

Allow changes after viewing a warning and entering password. This option is recommended since it adds a layer of checks and balances.The added security of the password can prevent you or your employees from accidentally making changes in the transaction from the closed accounting period.

-

Enter and confirm a closing password. Remember to keep this password confidential – don’t share it with your staff.

-

Select Save.

WHAT IF I NEED TO CHANGE SOMETHING AFTER I HAVE CLOSED THE BOOKS?

Keep these best practices in mind:

-

Consult your tax accountant if you need to change transactions to a prior year after a tax return has been filed.

-

In many cases, you should be adjusting a transaction in the current period (current period is accountant talk for “today” or “this month” – a period that hasn’t been closed yet). For example, instead of deleting an invoice – you should issue a credit memo in the current period. Another example would be – instead of deleting a check, a check should be voided in the current period.

-

In some cases, a change to a closed period is needed. If so, You should make the change and not share the closing password with your employees.

SHOULD I SHARE THE CLOSING PASSWORD WITH MY EMPLOYEES?

No, you should not. That would defeat the whole purpose of keeping others from making changes to closed periods.

DO I NEED TO DO ANYTHING ELSE TO CLOSE THE BOOKS IN QUICKBOOKS ONLINE?

No, that’s all you need to do. At year end, QuickBooks automatically closes out retained earnings and does other things in the background. You don’t have to worry about it.

IT’S YOUR TURN TO CLOSE THE BOOKS

Closing the books is a very important part of maintaining accurate reports in your QuickBooks. Now that you know how to close the books in QuickBooks Online, set up a reminder for yourself to close the books after your tax accountant finishes your tax return. Have a great week!

"Bookkeeping service", "How to close accounting period in quickbook online", "Quick book service","Quick Book Tutorial","Bookkeeping service","Low cost bookkeeping service"